What percentage is the inheritance tax?Good use of calculation methods and basic deductions that you want to remember | @Dime at Dime

When calculating the inheritance tax, it is necessary to based on the property after the basic deduction, not the property actually acquired by the heir.If you understand the correct calculation method, you will be able to proceed smoothly.I will explain in detail how to calculate and reduce the amount of tax.

What is inheritance tax in the first place?

Inheritance tax is a tax on the property when you get a property from a deceased person by inheritance.First, let's review the basic knowledge of inheritance tax.

Inheritance tax is "excessive progressive tax"

Income tax, gift tax, and inheritance tax are taxes subject to the progressive tax system.Progressive taxation refers to a mechanism that increases the tax amount as the taxation standard increases.

The purpose of progressive taxation is to collect more taxes from people with many income and property, and distribute to people with low income and property through social insurance systems.

There are two types of progressive taxation systems: simple progressive tax and super -progressive tax.If the taxation standard exceeds a certain amount, the tax rate is applied to the whole, and the excessive tax rate is to apply the tax rate only to the exceeded amount.

Simple progressive taxes may increase the tax amount extremely when the taxation standard is the border of the tax rate.For this reason, over -progressive taxation is used for the current progressive tax.Inheritance tax is also a tax for over -progressive taxation.

Reference: Inheritance and Tax | National Tax Agency

Basic deduction you need to know

Inheritance tax will not be levied unless the total heritage exceeds a certain amount.Basic deduction is the amount of inheritance tax.

The basic deduction of the inheritance tax is calculated in the formula of "30 million yen+(6 million yen x number of legal heirs)".If there are three statutory heirs, if the inheritance tax will be incurred in the basic deduction of 30 million yen+(6 million yen x 3) = 48 million yen, inheritance tax will not be incurred.

The larger the number of legal heirs, the more basic deductions, so it is more likely that the inheritance tax will not be incurred.If the total heritage does not exceed the deduction, there is no need to file a tax declaration or pay.

Reference: No.4152 Calculation of inheritance tax | National Tax Agency

Inheritance tax calculation method

(Source) Photo-AC.com

What kind of calculation should the inheritance tax be derived?I will explain how to calculate the tax amount while including calculation examples.

How many percent do you take for the total heritage?

The amount of inheritance tax is divided into the heir by subtracting the basic deduction amount from the total heritage, and the tax rate is calculated by multiplying each inheritance.

Inheritance tax is subject to over -progressive taxation, so the tax rate will increase as the acquisition amount increases.Check the specific tax rate in the inheritance tax speed calculation table published by the NTA.

The tax rate is set in the range of 10 to 55 %.The point is that the tax rate is distributed to the heir, instead of the tax rate on the total amount of taxable target, the tax rate is applied according to each acquisition.

Reference: No.4155 Inheritance Tax Tax Rate | National Tax Agency

Flow to calculate inheritance tax

When calculating the inheritance tax, first all the property is put together and gives the total heritage.If you have a debt, you must subtract it.

If you want the total heritage, deduct the basic deduction according to the number of legal heirs from the total heritage.If it is negative at this point, no inheritance tax will be incurred.

The taxable heritage that remains after deduction distributes the statutory inheritance to each heir.While looking at the speed calculation table, the inheritance tax amount for each heir is calculated in the formula of "Income amount x tax rate-deduction amount".

If the heritage is actually divided by legal inheritance, the amount of inheritance tax settled at this point is the amount imposed on each.If the actual inheritance ratio is different, the inheritance tax of each person is totaled and apportioned again.

Reference: No.4152 Calculation of inheritance tax | National Tax Agency

Inheritance tax calculation example

Let's consider a case where one wife and three children inherit 80 million yen.The basic deduction is 30 million yen+(6 million yen x 4) = 54 million yen, so the tax heritage is 80 million yen-54 million yen = 26 million yen.

If 26 million yen is divided into legal inheritance, the wife's acquisition amount is 13 million yen, 1/2 x 1/3 = 1/6 per child.

The inheritance tax calculated in the speed calculation table is 13 million yen x 15 % -500,000 yen for the wife, and about 4.33 million yen x 10 % = about 430,000 yen for one child.There is no deduction that can be deducted in the child's calculation.

The total of each inheritance tax is 1.45 million yen+about 430,000 yen x 3 = about 2.74 million yen.If the actual inheritance ratio is different from the statutory ratio, about 2.74 million yen will be redistributed to determine the tax amount for each person.

土地を相続した場合は?

The taxation standard for inheriting real estate is not the market price, but the "inheritance tax valuation".For buildings, the property tax valuation is used as it is, but in the case of land, it is evaluated by either the "route price method" or "magnification method".

The route price method is a method of evaluating land in areas where the route price is defined.Since the land price can be evaluated more accurately, if there is a route price, basically the route price method is adopted.

In order to evaluate land without a route price, use the magnification method to evaluate.This is a method of calculating the value of the land by multiplying the property tax valuation by multiplying the specified magnification.

How to reduce inheritance tax as much as possible

(Source) Photo-AC.com

For inheritance tax, there is a deduction system that can reduce the tax burden.Check out the typical ones.

Let's use tax deduction well

If the heir has received a gift from the heir within three years before the start of inheritance, the gift tax can be deducted from the inheritance tax.The tax deduction that can be directly closed from the tax will lead to a large tax saving.

If the amount of heritage acquired by the deceased's spouse is less than "160 million yen" or "statutory inheritance", the spouse does not impose an inheritance tax.It is a system to reduce the remaining spouse's tax burden.

In addition, by satisfying certain conditions, you can take measures such as minor deductions, deductions for people with disabilities, and subcontracting deductions.

Reference: Inheritance tax calculation and tax deduction | NTA

Configuration / editorial department

![lifehacker lifehacker LifeHacker LifeHacker A carabiner that is convenient for cutting packaging at the entrance. Excellent sharpness for medical blades! [Today's life hack tool] lifehacker lifehacker LifeHacker LifeHacker A carabiner that is convenient for cutting packaging at the entrance. Excellent sharpness for medical blades! [Today's life hack tool]](http://website-google-hk.oss-cn-hongkong.aliyuncs.com/drawing/223/2022-3-2/28016.jpeg)

![lifehacker lifehacker LifeHacker LifeHacker [2021] 7 Recommended Dishwashers | Introducing High Cospa & Compact Products lifehacker lifehacker LifeHacker LifeHacker [2021] 7 Recommended Dishwashers | Introducing High Cospa & Compact Products](http://website-google-hk.oss-cn-hongkong.aliyuncs.com/drawing/223/2022-3-2/30293.jpeg)

lifehacker lifehacker LifeHacker LifeHacker A carabiner that is convenient for cutting packaging at the entrance. Excellent sharpness for medical blades! [Today's life hack tool]

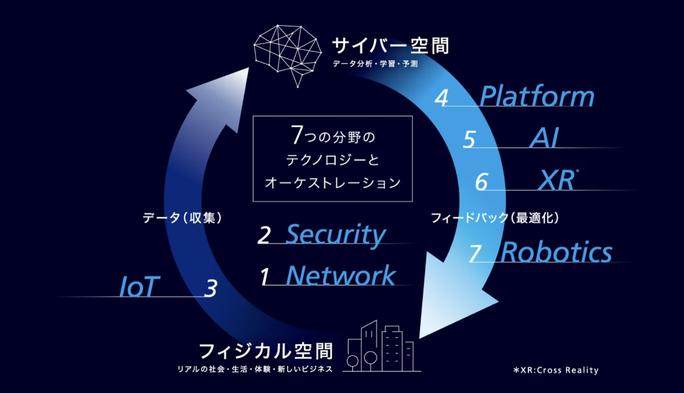

Will AI Concierge be realized in 2030? The future of KDDI's R & D (Part 1) | TIME & SPACE by KDDI

[2021] 11 latest recommendations for microwave ovens and ovens! Thorough explanation of how to choose

Recommended for studio rooms living alone, 5 "storage furniture" 5 selections and Yamazen are available in affordable furniture!